qyld stock dividend per share

Nasdaq 100 Covered Call ETFGlobal X Funds NASDAQ. On a per-share basis The company made 078 per share in earnings for the year a growth of 393 vs.

Qqqx Vs Qyld Comparing 2 Nasdaq 100 High Yield Funds Nasdaq Qqqx Seeking Alpha

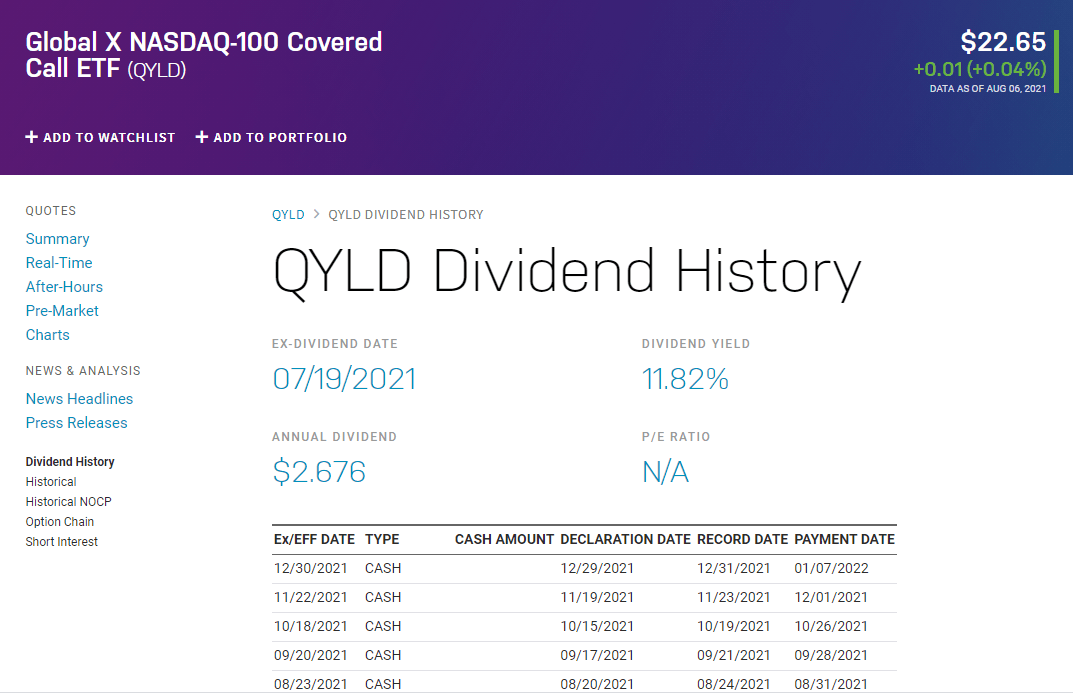

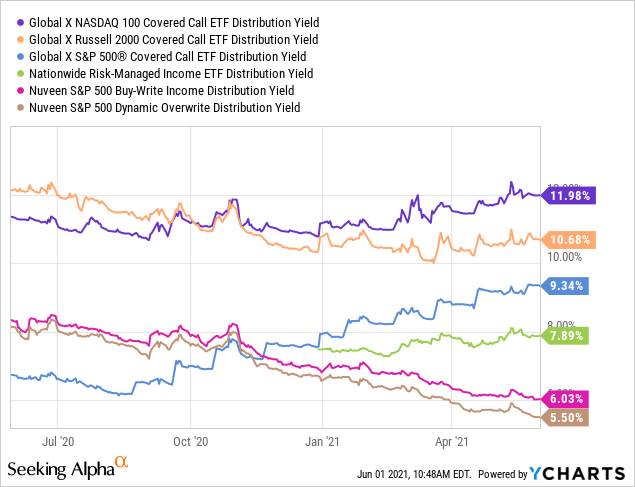

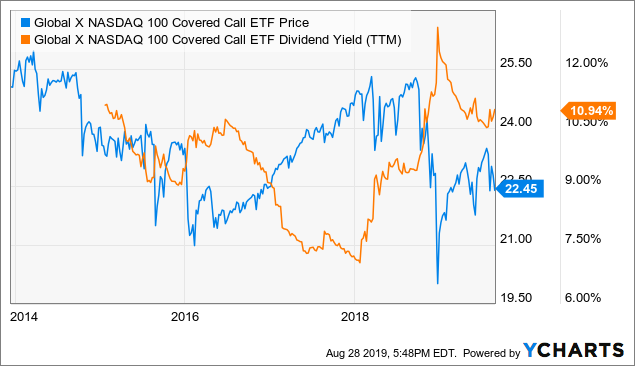

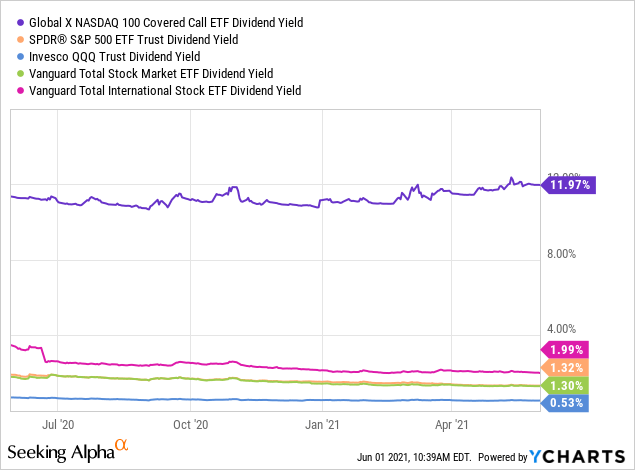

QYLD is mainly an income play with a dividend yield of 1082.

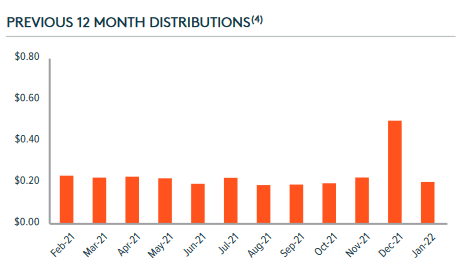

. QYLD is popular because this allows the fund to have a distribution yield upwards of 10 that pays monthly making it attractive to income investors. Ad Your Investments Done Your Way. QYLD on 02182022 declared a dividend of 02020 per share payable on March 02 2022 to shareholders of record as of February 23 2022.

Learn more about the QYLD 2305 ETF at ETF Channel. Dividend Yield Definition. Dividend amount recorded is an increase of 00077 from last dividend Paid.

Nasdaq 100 Covered Call ETFGlobal X Funds NASDAQ. Is QYLD the best dividend stock. Find the latest Global X NASDAQ 100 Covered Call ETF QYLD stock quote history news and other vital information to help you with your stock trading and investing.

Nasdaq 100 Covered Call ETFGlobal X Funds NASDAQQYLD on 03182022 declared a dividend of 02097 per share payable on March 29 2022 to shareholders of record as of March 22 2022. 02097 for March 21 2022. QYLD has a dividend yield higher than 75 of all dividend-paying stocks making it a leading dividend payer.

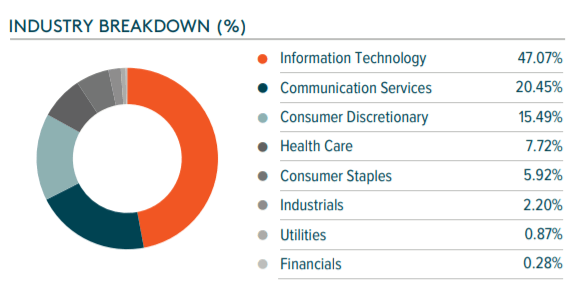

The fund holds stocks in the NASDAQ 100 and writes 1-month at-the-money calls on them. Data is currently not available. Since the stock has fallen to 20 a share though the portfolio is only worth 8546 right now.

The next dividend is forecast to go ex-div in 19 days and is expected to be paid in 2 months. Ad Search Ex-Dividend Dates Dividend Calendar All-Star Rankings More. Unique Tools to Help You Invest Your Way.

View Global X NASDAQ 100 Covered Call ETFs dividend history. 99 rows QYLD Dividend Information. If you set up your DRIP and reach 100000 shares you can be paid around 20000 a month.

Global X NASDAQ 100 Covered Call ETFs most recent monthly dividend payment of 02020 per share was made to shareholders on Wednesday March 2 2022. The dividend is paid every month and the last ex-dividend date was Mar 21 2022. Assume you had bought 1000 worth of shares before one year on Feb 22 2021.

Global X NASDAQ 100 Covered Call ETF pays an annual dividend of 279 per share and currently has a dividend yield of 1363. NASDAQQYLD Dividend Payment Schedule. QYLD on 06-18-2021 declared a dividend of 01939 per share.

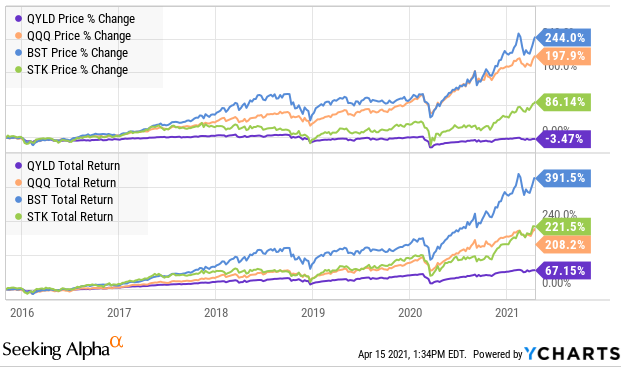

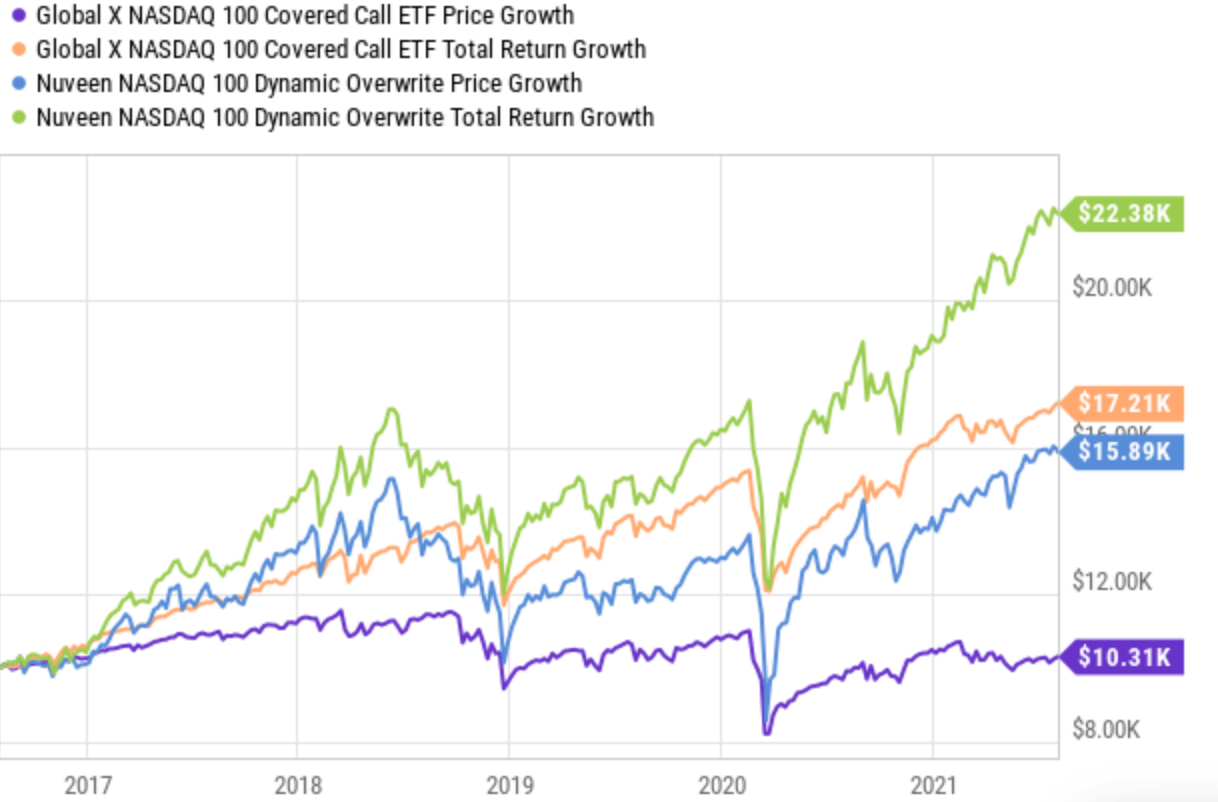

Nothing proprietary going on. One portfolio in blue here invested 10000 in shares of QYLD five years ago for 2346 per share. Horizons NASDAQ 100 Covered Call ETF QYLD paid a dividend of 0202 per share on Feb 22 2022.

Dividend amount recorded is a decrease of 0001 from last dividend Paid. When considering the 2305 stock dividend history we have taken known splits into account such that the QYLD dividend history is presented on. On 02182022 declared a dividend of 02020 per share.

QYLD charges a fairly hefty 060 for this strategy. Over the five years the investor collects about 243 per share in dividends each year or just over 1036 and a 103 dividend yield. QYLD Dividend History Description 2305.

The previous Global X Funds - Global X NASDAQ 100 Covered Call ETF QYLD dividend was 2097c and was paid yesterday. 26 rows QYLD Dividend. Companies that pay dividends tend to have consistent positive net income.

Owning stock in a company generally confers both corporate voting rights and income from any dividends paid to the stock owner. We expect annual returns of 15 going forward comprised of 3 expected earnings growth the 6 dividend yield and a. QYLD Factset Analytics Insight.

The dividend yield measures the ratio of dividends paid share price. QYLD tracks an index that holds Nasdaq 100 stocks and sells call options on those stocks to collect the premiums. Current Dividend Payment per Share.

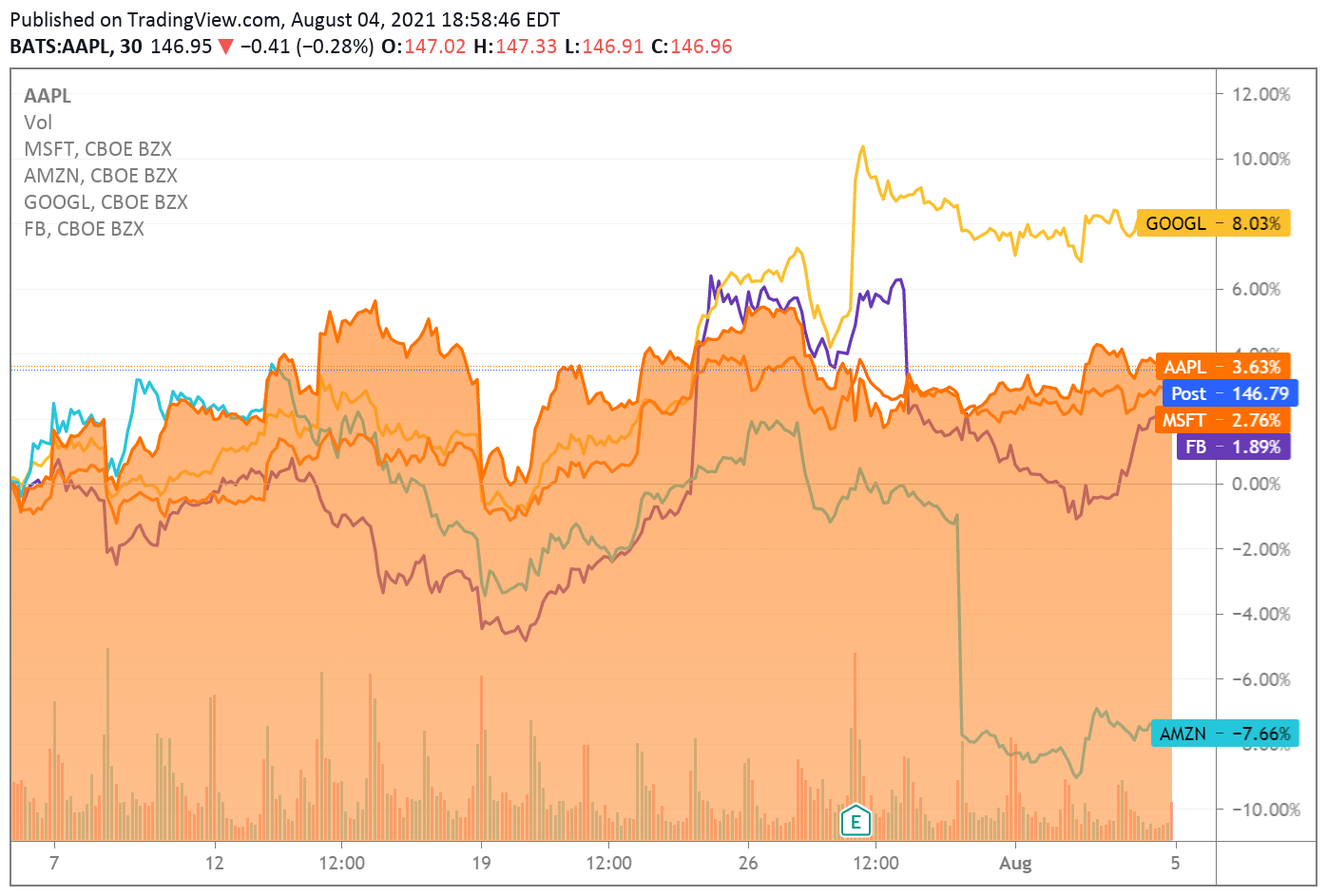

Here is your answer. Its share price will move with that of QQQ but it gives up even more of the. Global X Dividends Analysis For Valuation There are various types of dividends Global X can pay to its shareholders and the actual value of the dividend is determined on a per-share basis.

The closing price during Feb 22 2021 was 2282. Companies with a higher dividend yield tend to have a business model that allows them to pay out more dividends from net income like real estate and consumer defensive stocks. QYLD has a dividend yield of 1349 and paid 279 per share in the past year.

Is Qyld A Good Choice For Dividend Portfolios What To Make Of Its 14 Yield Seeking Alpha

Dividend Growth Stock Of The Month For October 2021 Nasdaq 100 Covered Call Etf Qyld Dividends And Income

Fdvv Vs Qyld Comparing High Yield To Dividend Fund Usefidelity

Global X Nasdaq 100 Covered Call Etf Qyld Covered Call Etf 11 9 Yield Seeking Alpha

Qyld Avoid This Etf As A Long Term Investment A Review

Beware Of Some Caveats Before Purchasing This High Yield Covered Call Etf Nasdaq Qyld Seeking Alpha

Understanding Qyld And Its 12 Dividend Yield For Beginners By Project Theta Medium

Is Qyld A Good Choice For Dividend Portfolios What To Make Of Its 14 Yield Seeking Alpha

Qyld A Sell Now A Buy Later Nasdaq Qyld Seeking Alpha

Is Qyld A Good Choice For Dividend Portfolios What To Make Of Its 14 Yield Seeking Alpha

Global X Nasdaq 100 Covered Call Etf Qyld Covered Call Etf 11 9 Yield Seeking Alpha

Don T Buy Qyld Buy These Cefs Instead Nasdaq Qyld Seeking Alpha

Qyld Qqqx Covered Call Etfs Dividend Gods

Qyld Time To Grab 11 86 Yielding Fund Before Tech S Next Run Seeking Alpha

Qyld Avoid This Etf As A Long Term Investment A Review

Qyld 12 Tech Yield But There S A Hidden Outperforming Alternative Nasdaq Qyld Seeking Alpha

Understanding Qyld And Its 12 Dividend Yield For Beginners By Project Theta Medium