seattle payroll tax calculator

Use the paycheck calculator to figure out how much to put. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Washington.

Seattle S Payroll Expense Tax Upheld By Trial Court Time For Employers To Gear Up For Reporting Insights Davis Wright Tremaine

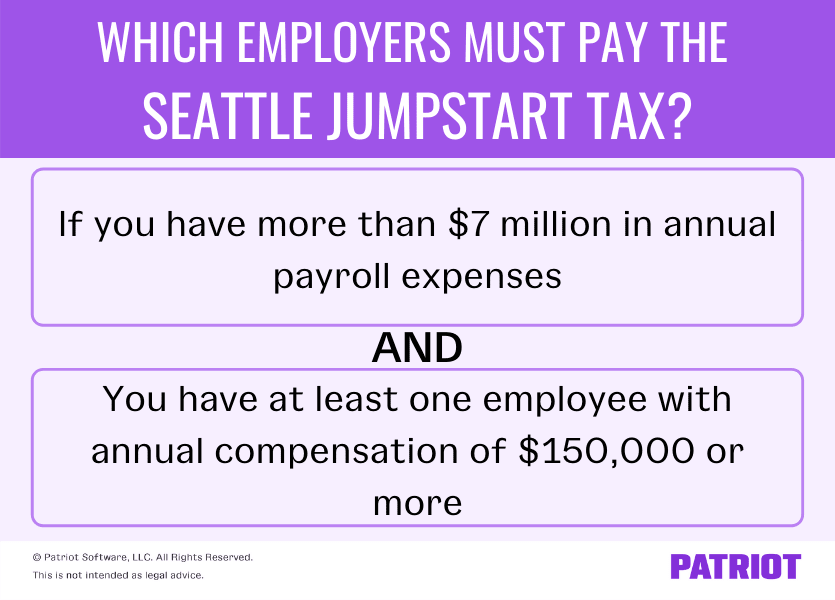

Only businesses with 7386494 or more of payroll expense in Seattle for the past calendar year 2021 for the tax year 2022 are subject to the Payroll Expense Tax.

. 2022 Minimum Wage Calculator Calculate the 2022 minimum wage for employees working in Seattle. While local sales taxes in Seattle Tacoma and some other metro areas are significantly higher than the national average. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Percent of income to taxes 25. 7386494 or more of payroll expense in Seattle for the past calendar year. Washington Salary Paycheck Calculator.

For example if an employee earns 1500. Discover ADP For Payroll Benefits Time Talent HR More. Plug in the amount of money youd like to take home each pay period and this.

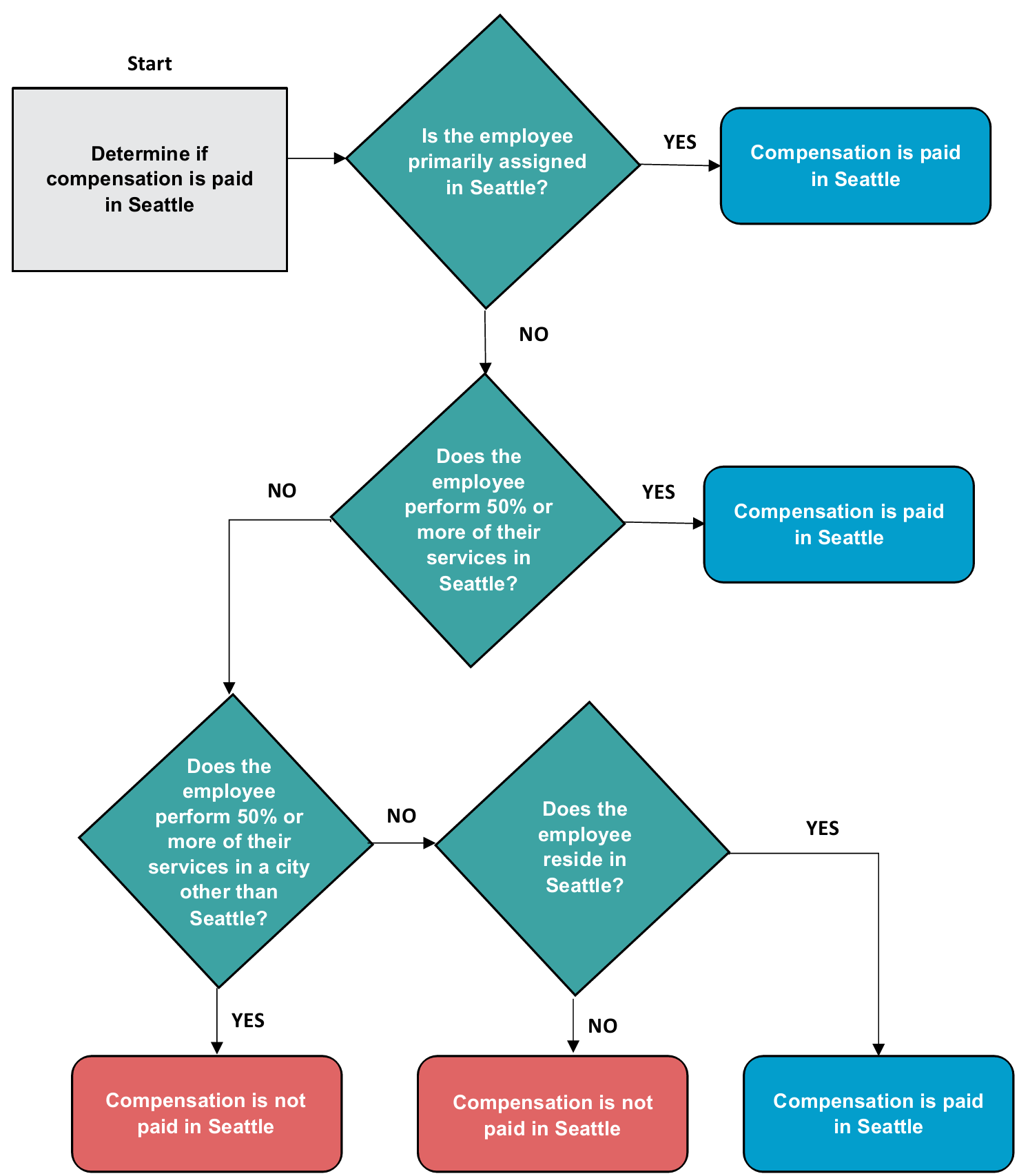

For example in 2021 businesses that had 7 million or more in seattle. Employers must calculate the Seattle payroll for all employees including those earning less than 150000. Find Easy-to-Use Online Payroll Companies Now.

These changing rates do not include the social cost tax of 122. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Get Started With ADP.

How to File a Tax Return. The City of Seattle Washington will impose a new employer-only Payroll Expense Tax effective 1 January 2021The filing of this tax was optional until Q4 2021and Zenefits is. The payroll expense tax is required of businesses with.

Our calculator has recently been updated to include both the latest Federal. Washington Hourly Paycheck Calculator. Use the paycheck calculator to figure out how much to put.

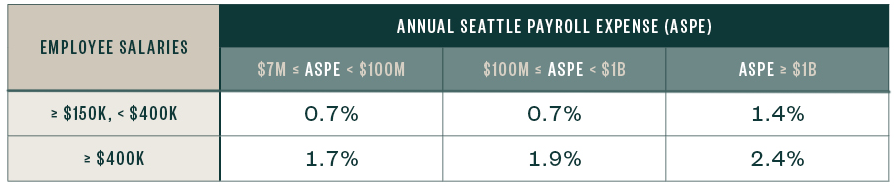

No Need to Transfer Your Old Payroll Data into the New Year. The tax rate ranges between 7 and 24 and is based on both the annual compensation paid to each employee and the total Seattle payroll expense of the business. 2021 Social Security Payroll Tax Employee Portion Medicare Withholding 2021 Employee Portion To contact the Seattle Department of Revenue please call 360-902-9620.

Your household income location filing status and number of personal. Seattles Payroll Expense Tax will begin on January 1 2021 and continuing to December 31 2040 applying rates ranging from 07 of payroll expenses up to 24 for companies with the. Employers can file a tax return online.

Payroll Doesnt Have to Be a Hassle Anymore. Calculate your Washington net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state. The Washington bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

You are able to use our Washington State Tax Calculator to calculate your total tax costs in the tax year 202122. Rates also change on a yearly basis ranging from 03 to 60 in 2022. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

How to calculate annual income. Enter up to six different hourly rates to estimate after-tax wages for hourly employees. Well do the math for youall you need to do is.

Ad Start Afresh in 2022. For 2022 the wage base is 62500. Ad Process Payroll Faster Easier With ADP Payroll.

Here S How Much Money You Take Home From A 75 000 Salary

Here S How Much Money You Take Home From A 75 000 Salary

Director Of Hr Salary In Seattle Wa Comparably

Seattle S Payroll Expense Tax Upheld By Trial Court Time For Employers To Gear Up For Reporting Insights Davis Wright Tremaine

New Tax Law Take Home Pay Calculator For 75 000 Salary

How Seattle S New Payroll Tax On Amazon And Other Big Businesses Will Work Geekwire

Seattle Wa Payroll Services Abdiwali Mohamed Cpa Pllc

Payroll Services Payroll Consultants In Kents Wa Tax Refund Income Tax Return Filing In Kent Wa Seattle Usa

Seattle Payroll Expense Excise Tax Details

Prepare Free Nanny Payroll With Our Excel Template Nanny Self Help

The Seattle Payroll Expense Tax What You Need To Know Clark Nuber Ps

Seattle S Payroll Expense Tax On Salaries Of Top Earners Bader Martin

Washington Paycheck Calculator Smartasset

Gusto Help Center Washington Registration And Tax Info